Effortless Superannuation Management for Australian Businesses

Stay compliant with changing ATO regulations, eliminate payment errors, and ensure timely super contributions, all in one intuitive platform.

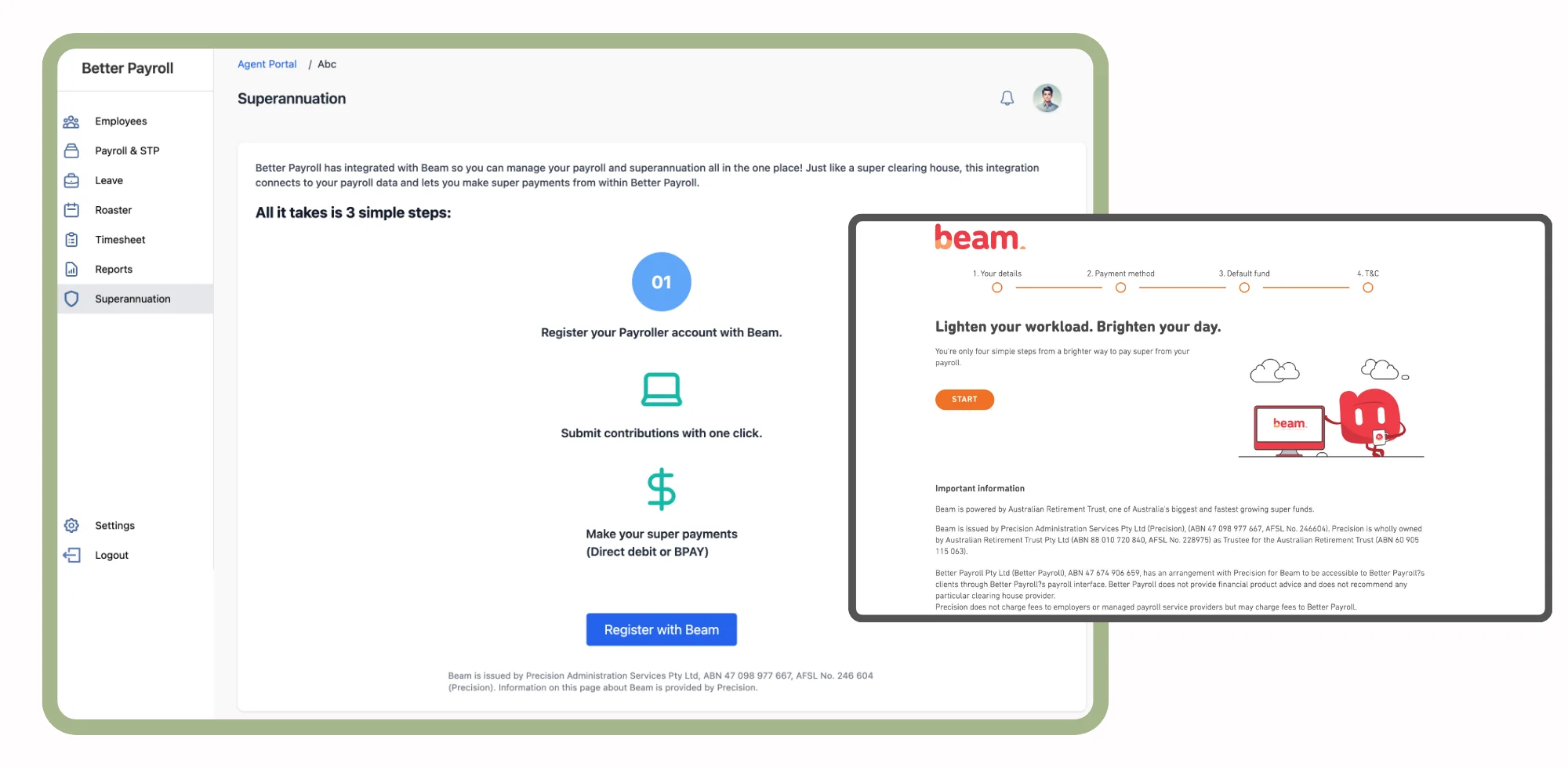

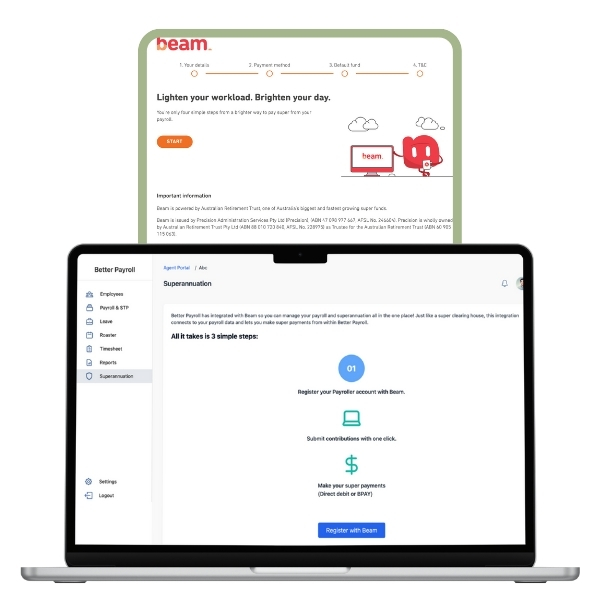

BetterPayroll’s Superannuation Module

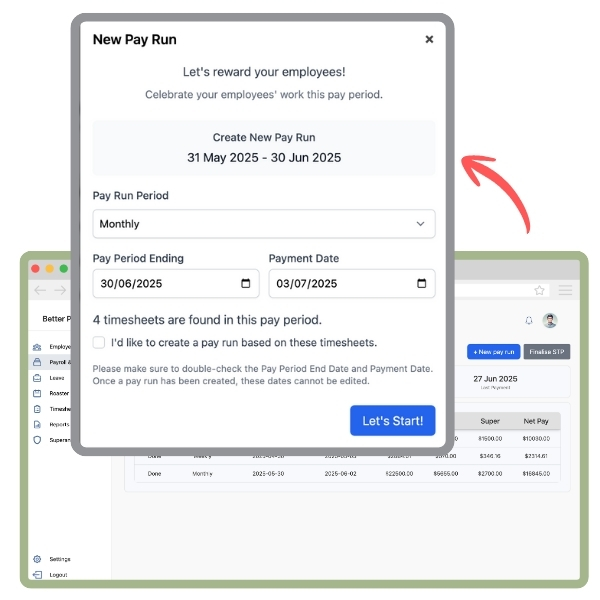

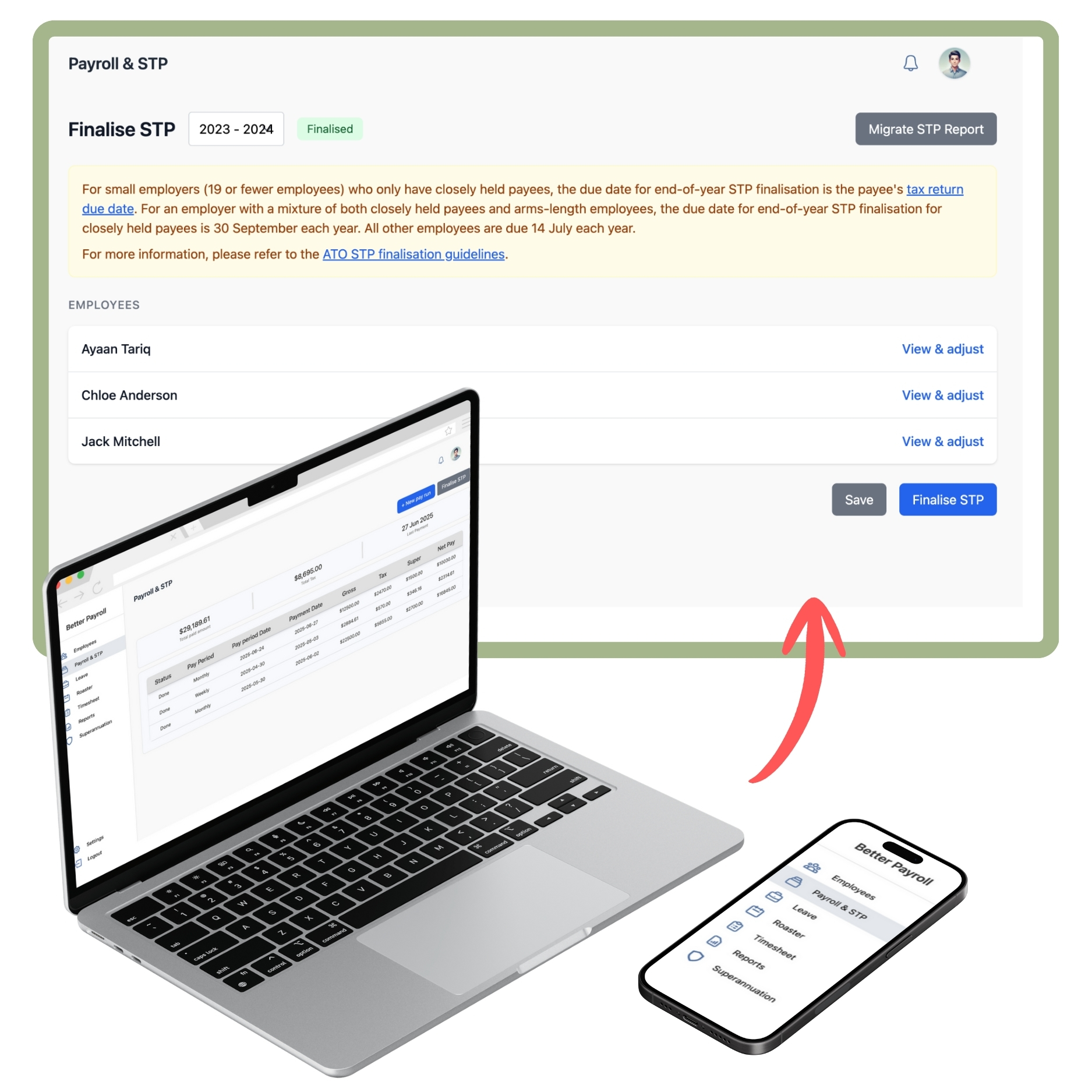

Automated Super Calculations & Payments

Automatically calculate contributions based on eligible earnings and process payments via SuperStream, ensuring timely and accurate results.

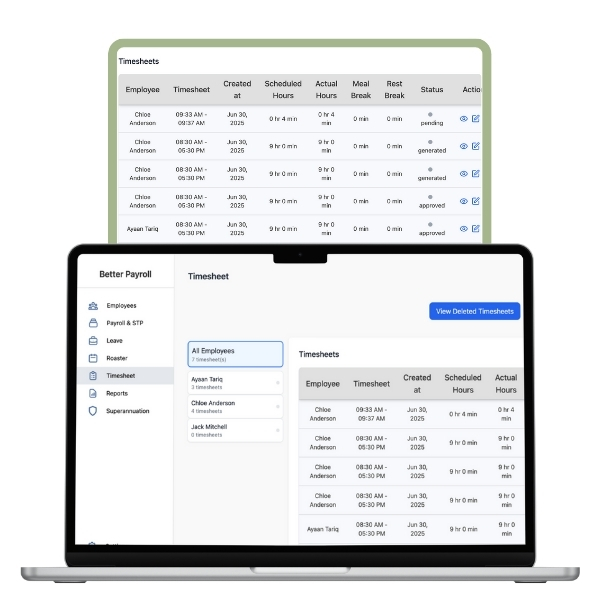

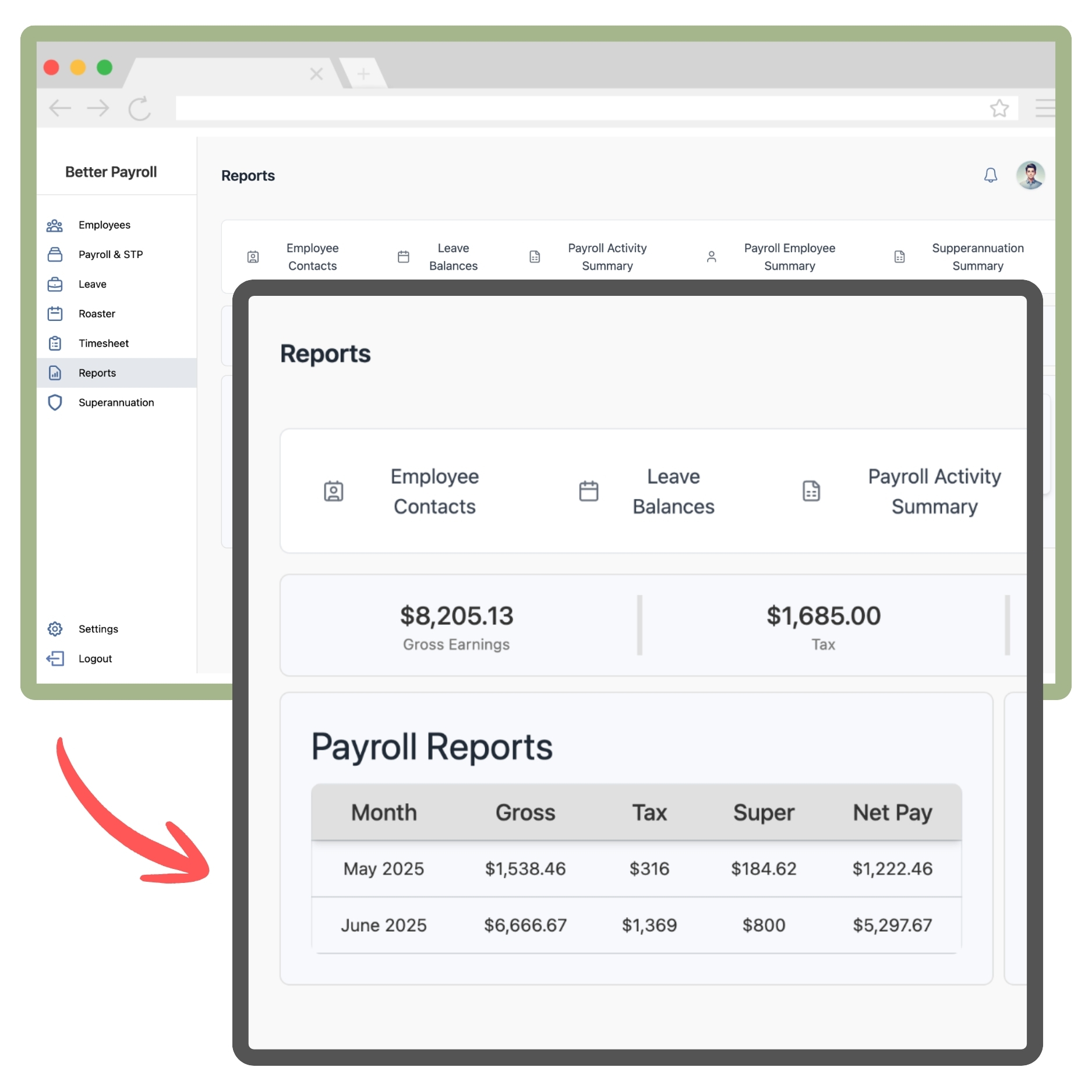

Precision Reporting & Record-Keeping

Track contributions per employee, fund membership, and payment dates. Our reports simplify audits, ensuring records are retention-ready.

Precision Reporting & Record-Keeping

Track contributions per employee, fund membership, and payment dates. Our reports simplify audits, ensuring records are retention-ready.

Always Compliant & Up-to-Date

We stay ahead of legislated changes, whether it’s new contribution rates or payday superannuation rules, so you never fall behind.

Error Detection & Correction

Raised red flags for under/overpayments, contractor misclassification, and late deadlines help you spot issues before they become costly.

Error Detection & Correction

Raised red flags for under/overpayments, contractor misclassification, and late deadlines help you spot issues before they become costly.

Future-proof Payday Super

Prepare for the 2026 superannuation reforms: manage increased payment frequencies without adding to your workload.

Key Features at a Glance

SuperStream Compliant Payments

Secure, automated super contributions via the ATO’s SuperStream channel

Contribution Rate Updates

Auto-refresh SG rate each July, no manual updates

Eligibility & Earnings Detection

System flags eligible employees and calculates based on OTE

Multi-Fund Support

Manage multiple super funds, including SMSFs

Reconciliation & Export

Auto-reconcile payments with bank feeds and export to accounting systems

Compliance Dashboard

View upcoming due dates, payment statuses, and audit alerts

Designed for Businesses of All Sizes

Whether you’re a lean startup or a growing SME:

- Save Time & Reduce Risk by automating repetitive super payments and admin tasks.

- Avoid Dollar Losses: Penalties, interest, and SGC blowouts from late or incorrect contributions.

- Enjoy Peace of Mind: Comprehensive record-keeping and audit-ready reporting built in.

Be Future Ready: Effortlessly adapt to upcoming super requirements.

Ready to Simplify Super?

Experience seamless superannuation management today:

✅ Start Your Free Trial – No credit card required