Payroll for Small Businesses in Australia

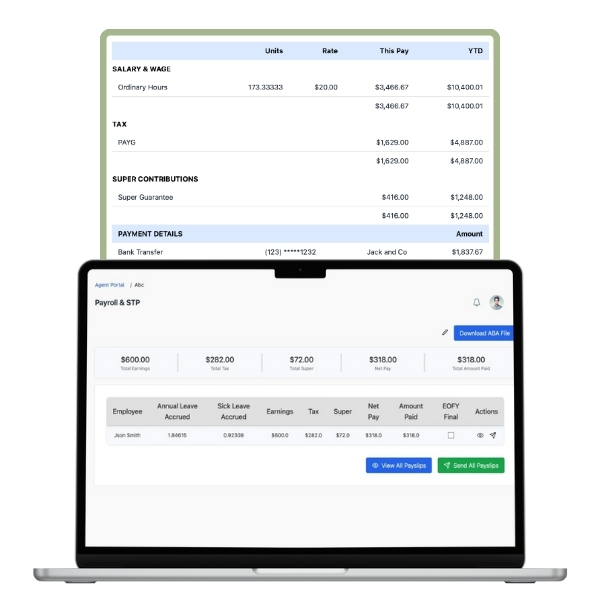

Running a small business is rewarding, but managing payroll can be complex. Better Payroll simplifies it, providing affordable, feature-rich solutions that save you time and reduce errors, all while keeping your business compliant.

Key Benefits for Small Business Owners

Always Compliant

Automatically stay up-to-date with STP-compliant payroll software for small businesses.

Time-Saving Automation

Automate employee payslips, payroll, and timesheets in minutes.

Scalable Plans

Payroll software for small businesses that grows with your team.

Payroll Product Recommendations for Small Businesses

Built for Small Businesses in These Industries

Better Payroll streamlines payroll and compliance for small businesses in:

- Retail

- Restaurants & Hospitality

- Professional Services

- Healthcare & NDIS

Affordable Payroll Software Plans

Affordable pricing for small businesses that fits within your budget, with no surprises.

Monthly

$3.50

/monthly per employee*

- STP (Web + Mobile)

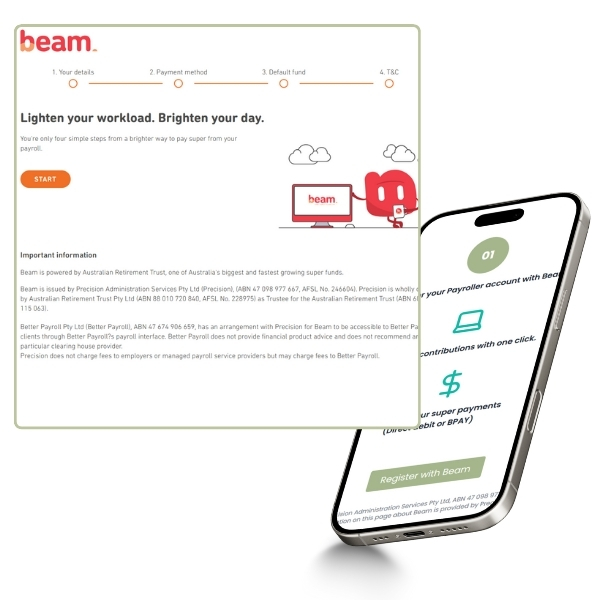

- Superannuation Payments

- Xero/MYOB Integrations

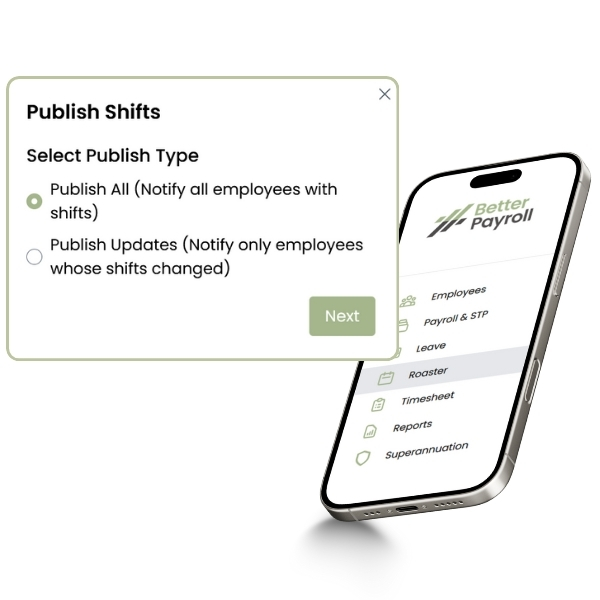

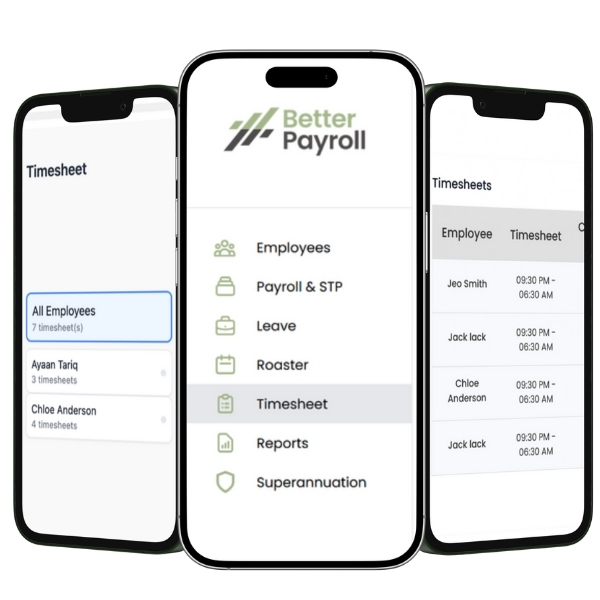

- Timesheets, Rostering, Leave Management

- Employee Mobile App

- Unlimited Pay Runs

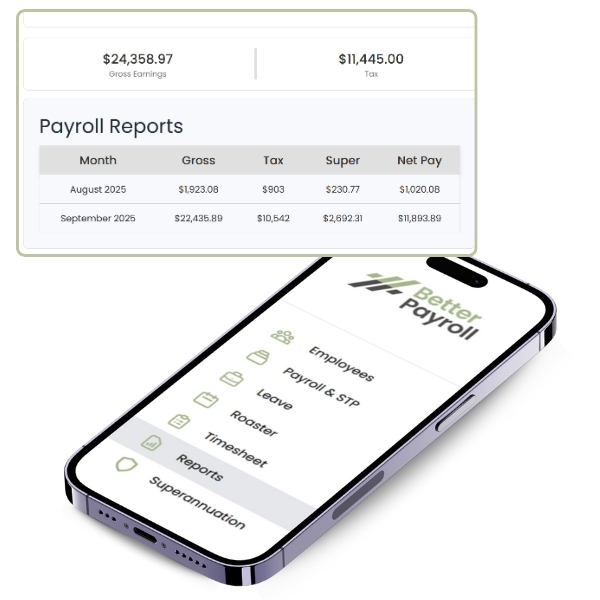

- Standard & Advanced Reports

Yearly

$2.50

/monthly per employee**

- STP (Web + Mobile)

- Superannuation Payments

- Xero/MYOB Integrations

- Timesheets, Rostering, Leave Management

- Employee Mobile App

- Unlimited Pay Runs

- Standard & Advanced Reports

✅ 1 month free trial *Minimum Spend $14 per month **Minimum spend $10 per month based on 4 employees if paid yearly.

How Better Payroll Supports Your Business Growth

Efficient Payroll Automation

Automates payroll tasks, reducing manual work, errors, and freeing up time for business growth.

Insightful Reporting Tools

Provides instant access to detailed payroll, cost, and employee insights to make informed decisions.

Seamless System Integration

Integrates smoothly with accounting and HR systems to simplify workflows and maintain accurate records.

What Our Customers Are Saying

Better Payroll has transformed our payroll process. Automating payslips, leave, and timesheets saves hours weekly, reduces errors, and allows me to focus on growing our restaurant efficiently.

Jack

Restaurant Owner

Integration with our accounting software is flawless. Payroll updates automatically, eliminating duplication, making compliance and reporting faster and completely stress-free.

Amelia

Retail Store Manager

The software ensures perfect STP compliance and simplifies tax and super management. Our small business runs efficiently with minimal effort, and support is always responsive.

Sophia

Healthcare Provider

FAQ for Small Businesses

It manages wage payments, tax, superannuation, STP reporting, payslips, and compliance – so you spend less time on admin and more on growth.

It automatically reports payroll information to the ATO with each pay run – keeping you compliant without extra steps.

We integrate seamlessly with accounting software so you can sync payroll and financial data with ease.

Look for STP, automatic tax & super, automatic leave accrual, employee self‑service, and timesheet integration.

Yes, built‑in automation and compliance checks significantly lower human error compared to spreadsheets.

Modern payroll tools automatically manage varied payroll obligations across states without manual intervention.

Faster bookkeeping, improved accuracy, automated compliance reporting, and easier audit preparation.

It unifies financial tasks (payroll, invoicing, reporting), reduces manual work, and delivers data insights in real time.

Yes, because cloud systems scale with your business, from simple payroll up to complex payroll + HR workflows.