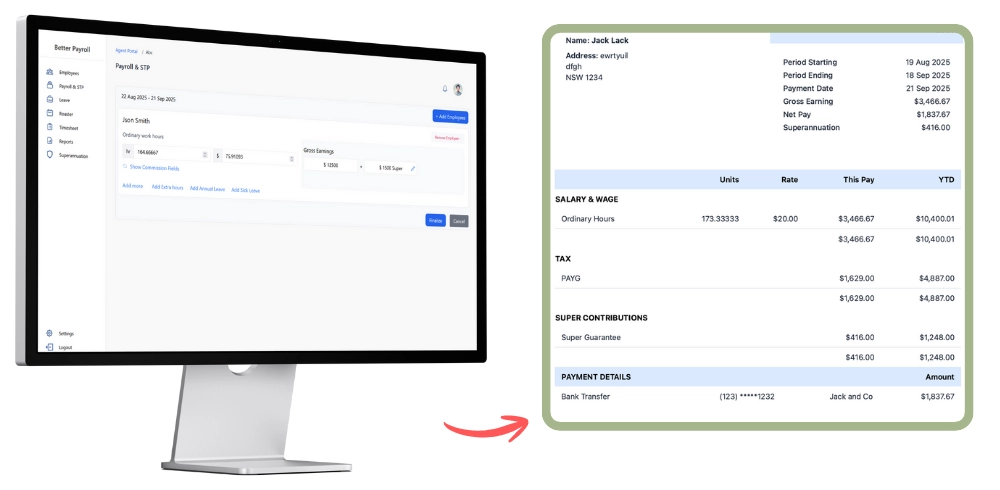

Payslip Generation Made Easy with BetterPayroll

Accessing and issuing payslips through BetterPayroll is streamlined for agents, helping accountants and payroll professionals manage client payroll efficiently and stay compliant with STP Phase 2.

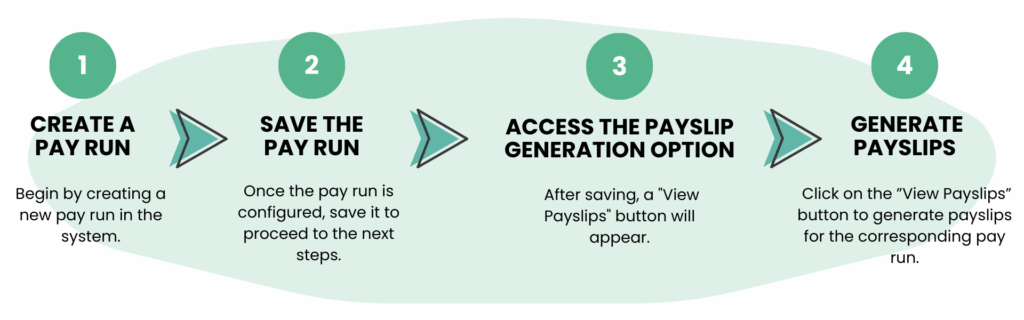

How to Generate Payslips

Why Our Payslip Process Stands Out

- Agent-Friendly Access: Designed for accountants, BAS agents, and tax professionals using Agent accounts managing multiple client payrolls.

- Seamless STP Reporting: Payslips are generated as part of the end-to-end pay run, ready for STP Phase 2 lodgement to the ATO.

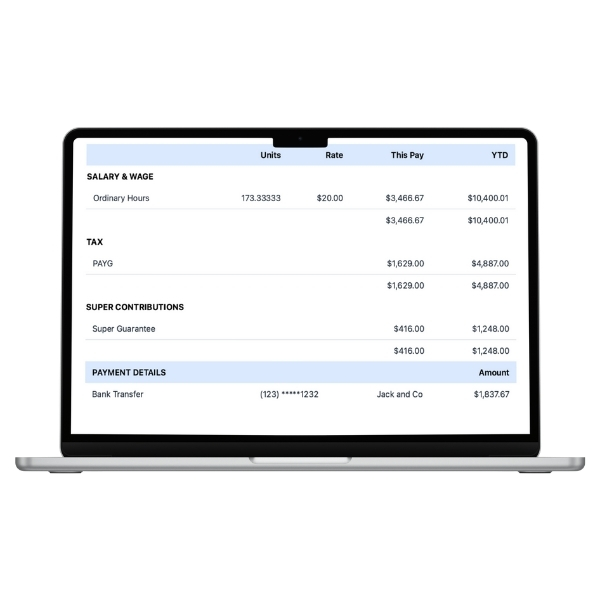

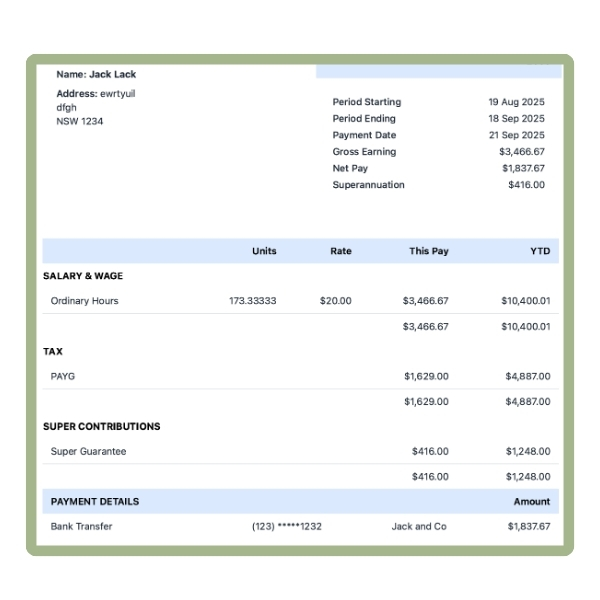

- Fast & Accurate: Within minutes, generate final payslips with accurate gross, PAYG, super, and net amounts without manual duplication.

Audit-Ready Records: Every payslip is stored within the system, easily retrievable for audit trails or internal history.

Why Our Payslip Process Stands Out

- Agent-Friendly Access: Designed for accountants, BAS agents, and tax professionals using Agent accounts managing multiple client payrolls.

- Seamless STP Reporting: Payslips are generated as part of the end-to-end pay run, ready for STP Phase 2 lodgement to the ATO.

- Fast & Accurate: Within minutes, generate final payslips with accurate gross, PAYG, super, and net amounts without manual duplication.

Audit-Ready Records: Every payslip is stored within the system, easily retrievable for audit trails or internal history.

Best Practices & Tips

- Always Save Before Viewing: Only saved pay runs enable the “View Payslips” action.

- Review Payslip Details: Double-check earnings, deductions, super, and tax before final lodgement.

- Deliver Securely: Use encrypted email or client portals to ensure payslips reach the intended recipient safely and securely.

Stay Compliant: Payslips must be issued within one working day of payment to meet Fair Work obligations.