Payroll Software for Creative Services & Freelancers

BetterPayroll empowers creative studios, freelancers, agencies, and independent contractors with secure, accurate payroll tools built for STP compliance, award interpretation, and flexibility, all aligned with Australian payroll law.

Why Creatives & Freelancers Choose BetterPayroll

Compliance with ATO & Fair Work Regulations

In Australia, around 39% of businesses report payroll errors due to outdated systems or misinterpreting awards. BetterPayroll reduces that risk with validated payroll workflows.

Streamlined Payroll for Solo and Project-Based Workers

Many creatives juggle multiple clients, part-time roles, and contract work. BetterPayroll handles timesheets, superannuation, and STP reporting without complex spreadsheets or payroll errors.

Freelancer & Casual Workforce Support

Our platform manages casual award rates, allowances, overtime, and tax deductions, while freelancers access self-service tools for payslips and ABN details.

Feature Highlights for Creative Professionals

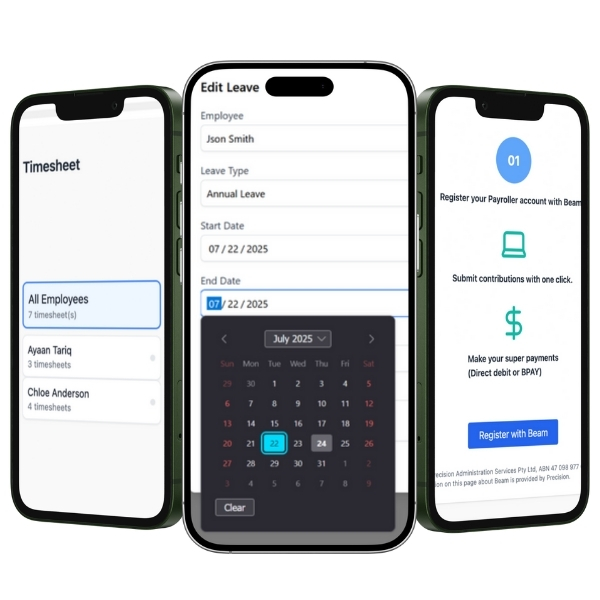

Flexible Hour & Project-Based Timesheets

Track hours by client or project, whether short gigs or long-term contracts, accessible on desktop or mobile.

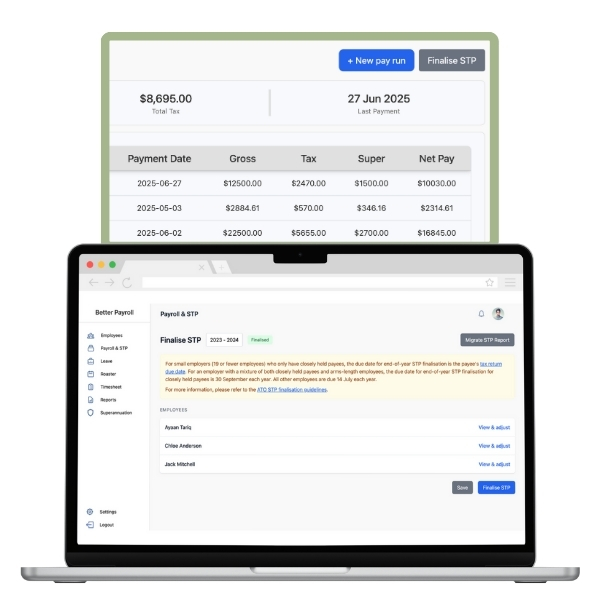

Automated STP Phase 2 Reporting

Submit detailed income types, TFNs, super data, and award codes to the ATO with real-time validation, no manual uploads required.

Award & Tax Rule Automation

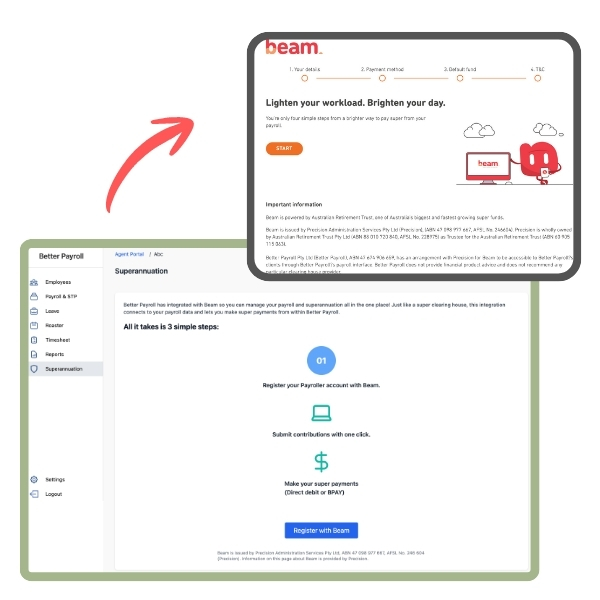

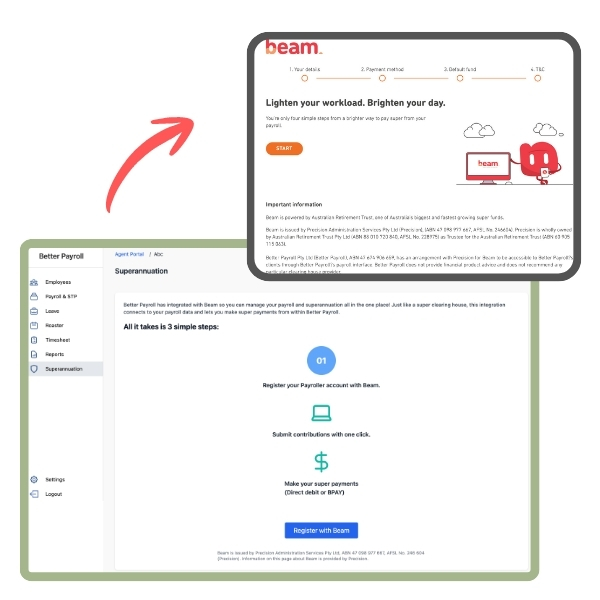

Calculate PAYG withholding, earnings, penalties, and super contributions accurately, even across varied pay structures.

Employee Self-Service Portal

Staff and contractors access payslips, tax forms, and leave balances, reducing time spent chasing documents.

Accounting & App Integrations

Seamlessly link with Xero, MYOB, or accounting tools tailored for freelancers like QuickBooks, FreshBooks, or time-tracking apps.

Creative-Specific Benefits

| Benefit | Value for Creative Professionals |

|---|---|

| Payroll Precision | Avoid underpayment and manual calculation errors. |

| Workflow Flexibility | Adapt to varied project lengths and client billing. |

| Built-in Compliance | STP Phase 2, super, and tax coverage without extra admin. |

| Scales With Your Business | Use as a solo freelancer or growing studio, no migration needed. |

| Self-Service Support | Freelancers and teams manage their own payroll details. |

Why BetterPayroll Works for Creatives

Tailored for Independent & Agency Workflows

Unlike generic payroll platforms, we design for creative business structures, hourly rates, job tracking, client differentiation, layered roles, and casual team setups.

Australian Compliance Covered

With changing award interpretations and wage theft regulations, our system and support team help ensure audit-ready accuracy.

Australian Compliance Covered

With changing award interpretations and wage theft regulations, our system and support team help ensure audit-ready accuracy.

Award-Scale Accuracy

By automating entitlements and penalties, we help prevent wage errors that affect both freelancers and creative staff.

Real-World Impact

Freelancers and agencies using BetterPayroll report:

- Time-shaving of up to 70% on pay runs

- Fewer payment disputes and billable errors

- Seamless transition to digital payslips and STP reporting

Ready to Free Up Time for Creativity?

Let BetterPayroll manage compliance, payroll, and entitlements, so you can do what you do best:

✅ Start Your Free Trial – No credit card needed

Join thousands of individual contractors and creative studios in Australia who trust BetterPayroll to get payroll right.