Single Touch Payroll (STP) Software for Australian Businesses

Ensure accurate and compliant payroll reporting to the ATO with Better Payroll’s Single Touch Payroll (STP) solution. Our flagship product is designed to simplify payroll for businesses of all sizes, from startups to enterprises, while staying fully compliant with STP Phase 2 requirements.

Why Better Payroll for STP?

ATO-Approved STP Software

Fully compliant with Australian Tax Office (ATO) regulations.

STP Phase 2 Ready

Report income types, TFNs, super, and more in real-time.

Automated Reporting

Submit payroll data directly to the ATO every pay run, no manual uploads needed.

Error Detection

Instantly flag reporting issues and validate data before submission.

Audit Ready

Keep a transparent and accessible record of every STP lodgement.

Key Features of Our STP Payroll Software

Automated Tax Calculations

Accurately calculate PAYG, super, and leave entitlements.

Direct Deposit

Pay your employees securely via bank transfer with scheduled pay runs.

Employee Self-Service Portal

Let employees access pay slips, update tax details, and manage leave online.

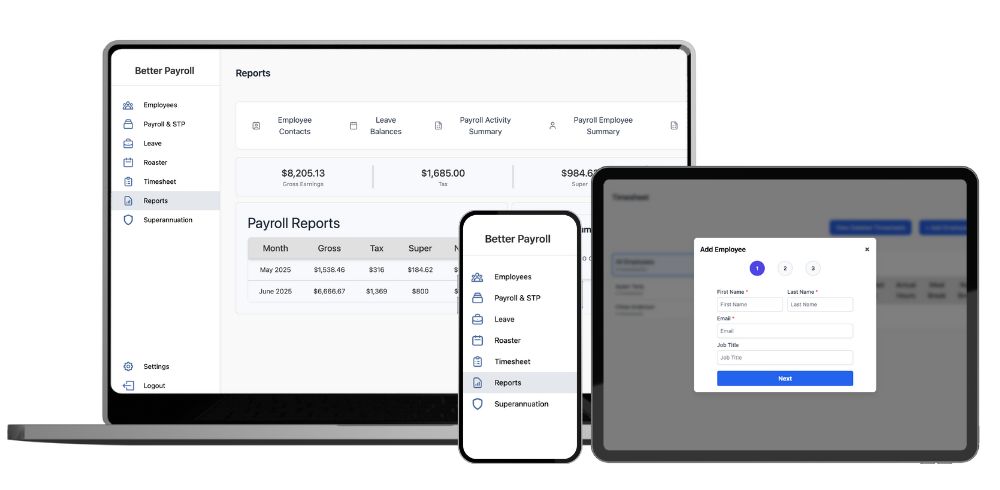

Payroll Dashboard

Track payroll status, STP lodgements, and compliance tasks in one place.

Integration Ready

Connect with accounting tools like Xero, MYOB, and QuickBooks.

Built for Small to Large Businesses

Whether you’re hiring your first employee or managing payroll for hundreds, our STP software for small businesses and enterprises scales with you. Join thousands of Australian businesses who trust Better Payroll to simplify compliance and reduce risk.

Get Started with Better Payroll Today

Take the stress out of payroll and STP compliance with a modern solution that just works.

✅ Start Your Free Trial – No credit card required

📅 Schedule a Live Demo – See it in action with our product experts